FINANCIAL FLOATATION: Interest Rates vs. House Prices

Published On: September 8, 2016 Posted by: Jeremy Peterson

House prices have been on an unprecedented tear this past year. Much of this has to do with the timely convergence of low interest rates, a booming local economy, and in-migration of people from other states.

So for fun (and I use that word liberally here) I did some number crunching to see how interest rates have behaved over time and how house prices have responded in kind.

Join me as we go on an odyssey back in time (like 8 years ago) to see if we can glean a few insights on the forces that make our market what it is today.

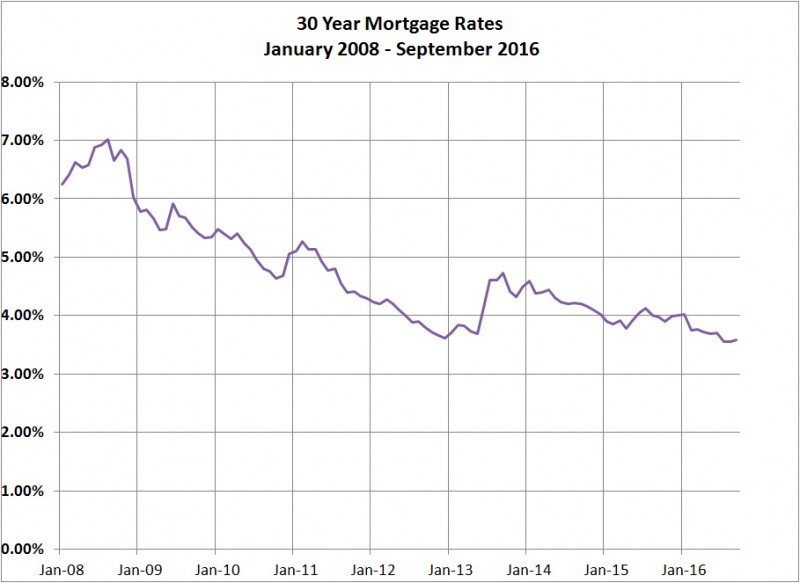

The last year of “normal” mortgage interest rates was 2008. Since that time, the Federal Reserve and money markets have entered a strange world of super low rates. You can see the slide into sub 4% rates where we are now. Historically, we can often think of interest rates as a thermometer. If they are too high, you have a fever, if they are too low, you are dead. The low rates of today seem to indicate a pekid and clammy diagnosis. Yet, that old historical analogy may have lost its meaning. Today’s low rates are acting more like an addictive stimulant…and withdrawals can be painful.

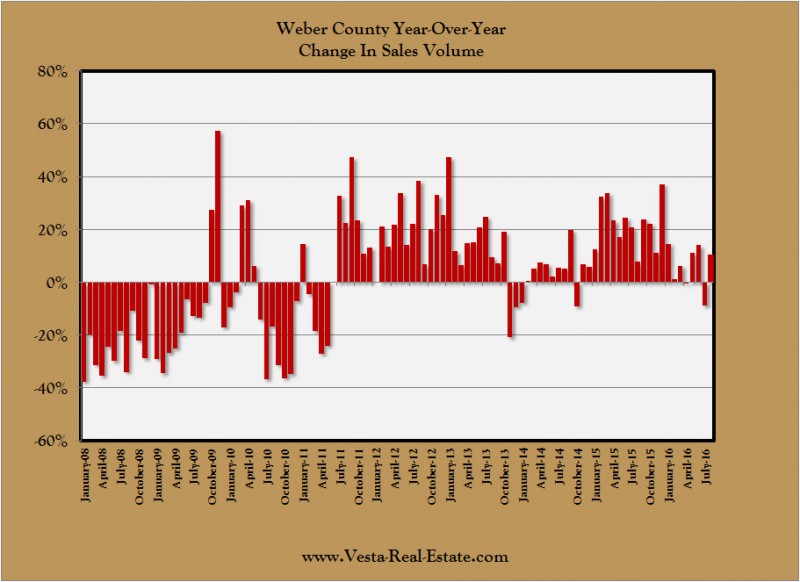

Here you can see monthly year-over-year home sales growth since 2008. The market was in the dumps for several years until mid-2011. At that time, interest rates dropped below 4.5% and stayed there until mid 2013 when an interest rate spike pushed rates close to that level again. You can see that sales growth subsided with the rates elevating in 2014. However, by 2015 rates had dropped to 4% and sales volume surged steadily again. Interestingly, rates continue to drop yet sales volume growth for 2016 has been choppy.

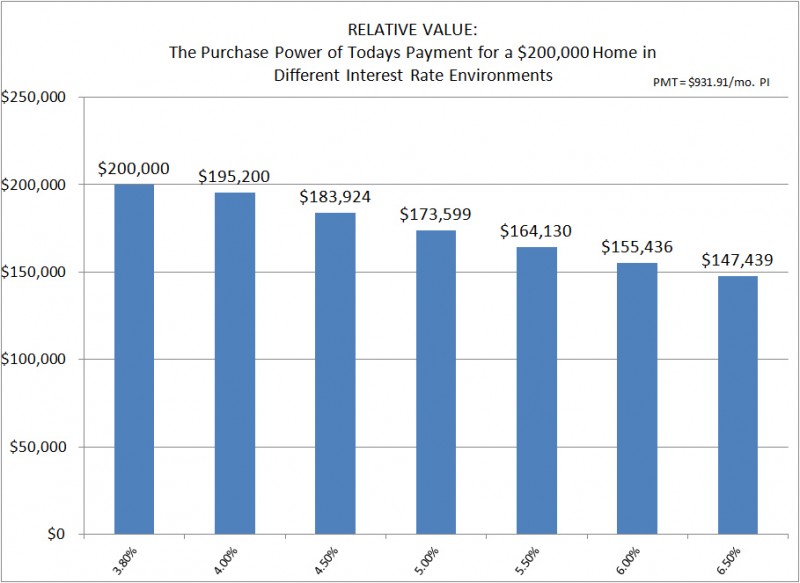

To understand how interest rates affect buyer behavior, lets take a look at the purchase power of a mortgage payment at various interest rates.

Today, a payment of $931.91 principal and interest will service a $200,000 loan. Most home buyers use a mortgage to make their acquisition so this is an important point. The higher the interest rate, the more of that payment will need to be contributed toward interest and thus the smaller the amount of principal it will be able to leverage. As you can see above, the same payment services smaller and smaller amounts of debt as interest rates increase. The payment that can get you a $200,000 loan today would only be enough to service $148,000 if rates were at 6.5%

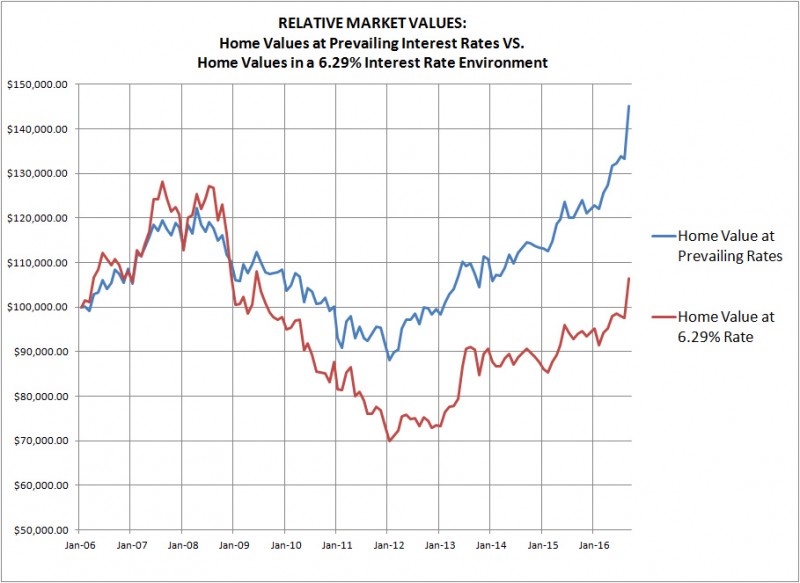

Here is how that would play out in a simulated scenario.

In this chart, the blue line shows the value of an average home that is 1352 SQFT in January 2016. The beginning value is $100,000. I used MLS $/SQFT data to extrapolate the value of the property through time. Interest rates for each month are as they have occurred historically. For the red line, I started the payment for the house at the same level it was in January 2016 when interest rates were 6.29%. Then the house value (assuming it would be purchased with a very low down payment) is adjusted based on the purchasing power of the actual historical house payment but reflecting a 6.29% interest rates over time. For instance, in July 2012 the home is worth $98,000 and rates were 3.89%. The house payment would be $463.00. So, if we take that house payment and associate with a 6.29% rate, the leveraged value drops to $75,000.

While this analysis is crude, it does help us understand how interest rates are driving house values in today’s real estate market. If for some reason interest rates were to spike to 6% tomorrow, we would see a sudden drop in real estate values across the board. It is simply a measure of leverage and affordability.

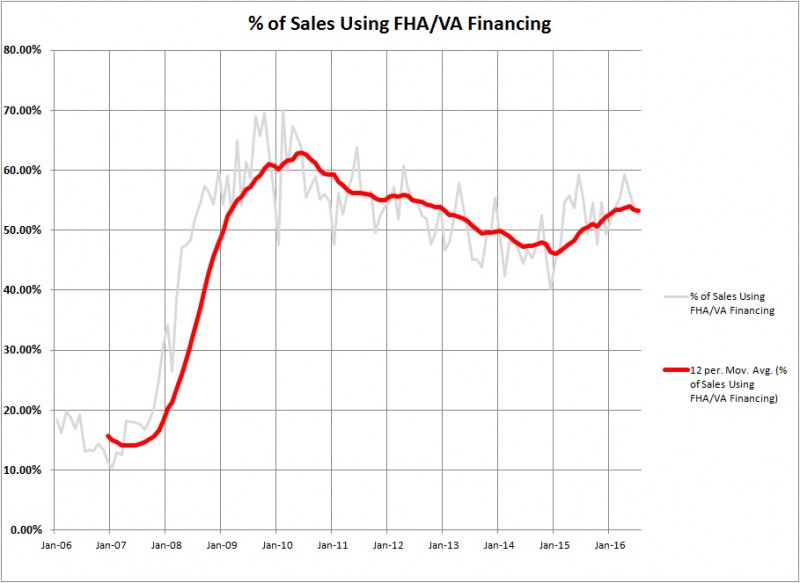

The leverage issue is significant because if buyers rely heavily on small down payments, house prices are more exposed to interest rate changes than in markets where buyers pay cash or use large down payments. The chart above shows how exposed Weber County’s market is to this risk. FHA and VA loans require a low 3.5% downpayment. Meanwhile, over half of the transactions occurring today are done with FHA or VA financing. Any sudden interest rate changes would affect these buyer’s purchasing power hardest.

I am not forecasting any major interest rate changes in the near future. However, it is important to be mindful of how these affect our marketplace. In the meantime, if you are purchasing a home, enjoy the low rates while they last.