The End of the 30-Year FHA Mortgage?

Published On: January 19, 2017 Posted by: Jeremy Peterson

The 30-Year fixed mortgage has been a mainstay of the housing market since the Great Depression. The collapse of the banking industry at that time sparked government intervention to prop up the housing market. Since then, home buyers have enjoyed taxpayer backing via FHA loans to help them purchase a home. The loans have unusually low down payment requirements with buyers needing just 3.5% of the purchase price to put toward equity up front.

However, when you live by government whim, you die by it as well. The recent change in Administration in Washington D.C. has spurred talk of phasing out government backing of FHA mortgages. Here are a few snippets from a recent Bloomberg article on the subject:

“Among the problems with curtailing the guarantee, supporters say, is the impact such a move would have on less-well-off borrowers who benefit the most from the subsidies. Fannie, Freddie and the FHA in effect subsidize the costs of riskier borrowers with fees from borrowers unlikely to default, said Sarah Wolff, senior researcher at the left-leaning Center for Responsible Lending.

…

But some in the housing industry say that without the government’s support, 30-year mortgages may become scarce, leaving home ownership out of reach for many Americans.

…

Ben Carson, Trump’s nominee to be secretary of the Department of Housing and Urban Development, told senators Thursday that the 30-year mortgage could survive without a government guarantee. He said the private market could take on much of the responsibility.

…

“You can’t do it overnight. It has to be a gradual change,” Carson said at his confirmation hearing. “We can’t do it in a haphazard way, and we can’t do it in an ideological way.”

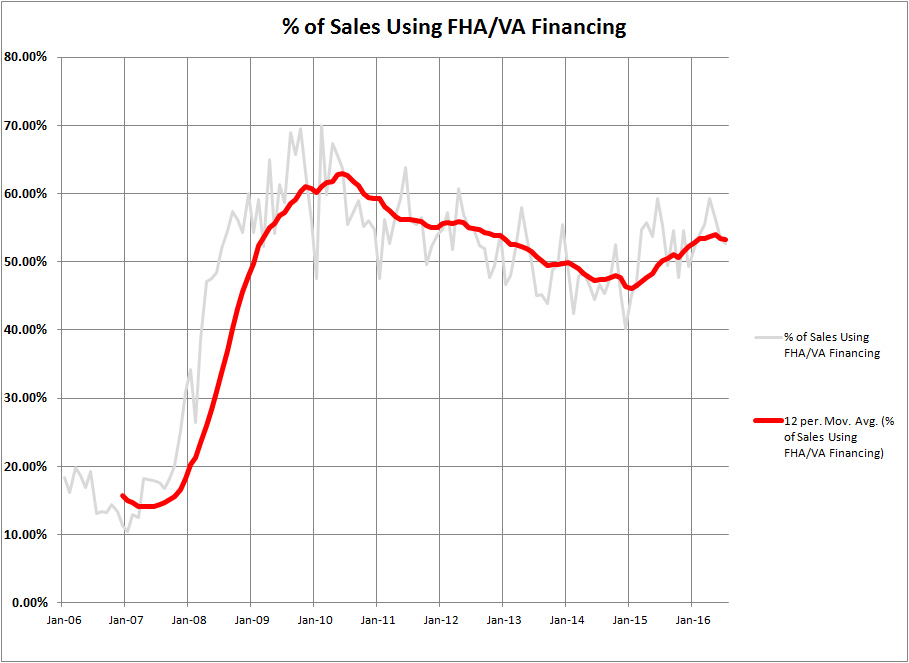

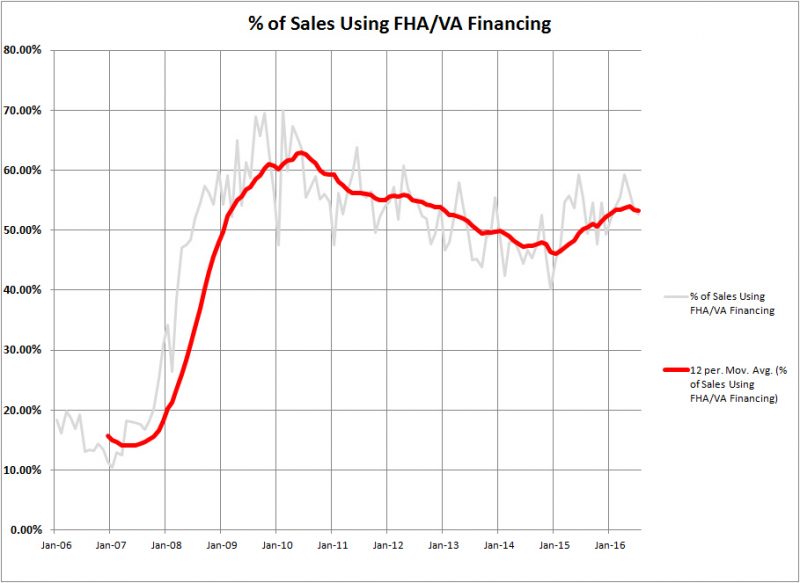

The big question is: What would happen to the housing market if FHA was replaced by private sector lending? To get a handle on that, lets take a look at what percentage of home purchases in Weber County involve FHA loans.

Presently, over half of all transactions are utilizing FHA financing. You can see that during the Housing bubble, that number droped to less than 15%. Private lenders carried the rest. But, lending guidelines were ridiculously lax back then.

If FHA disappears, I would be happy. Government intervention in the housing market has only distorted values and created moral hazards by subsidizing risky borrowers who aren’t quite prepared to purchase a home. I believe a reduction in dependency on taxpayer backed financing will promote healthy saving practices and encourage the improvement of the financial health of homebuyers and renters alike. I do believe it would reduce the annual number of real estate transactions in the market. But, I don’t expect it to be apocalyptic. I would also expect to see an increase in seller financed transactions as well. Still, we probably won’t go back to the way mortgage lending happened at the turn of the 20th century.

Let’s hope the future of lending has more freedom and more sanity moving forward.