TENANT DAMAGES: Serving Justice to the Damage-Prone

Published On: October 4, 2016 Posted by: Jeremy Peterson

Every landlord wants to make sure that their property is being treated adequately by tenants. So, when assessing the risk that a tenant might behave poorly, landlords look to several tools to help them weed out the bad actors. Credit and past rental references go a long way toward establishing the good character of a tenant. A healthy security deposit acts as a financial incentive to induce good performance by a tenant. But, while these tools work to reduce the risk, they cannot eliminate it entirely.

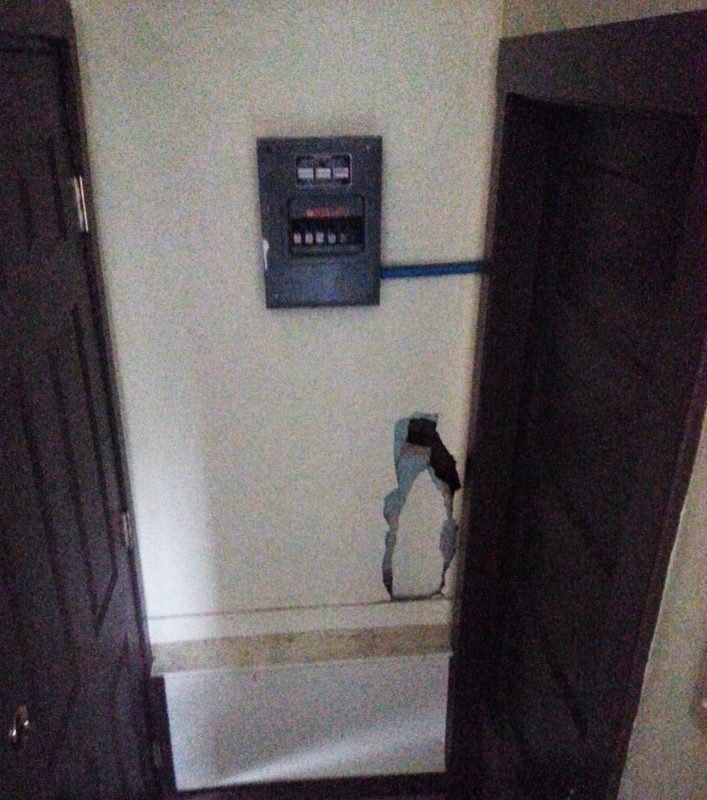

With that in mind, we recently experienced the disappointment that comes when a good tenant goes bad. In this case, the tenant inexplicably broke the bathroom sink and punched large holes in the walls of their freshly renovated one bedroom cottage.

Our maintenance crews had visited the property several times over the course of the year and said that the home was in good repair. However, the tenant had recently started getting behind on rent and paid slowly over the last two months of her lease. An exterior inspection of the property indicated that they had stopped caring for the yard and so we sent a notice telling them their lease was being ended.

At that point, the tenant stopped making rent payments entirely. Her phone no longer accepted calls or text messages and she responded rarely to email. She eventually left the property without returning keys or notifying us that she was completely out. After seeing that the furnishings were out of the home, we posted a Notice of Abandonment and took possession of the property. We learned at that point she left us with a $470 unpaid water bill.

Fortunately, the property can be fixed and made ready for the market. However, the extent of the damages will cost a couple thousand dollars to repair. The owner will have to front these funds while we get the property back to tenable condition. In this case, the property is now being prepared to be sold.

For a tenant to leave a landlord with such a big bill seems like an injustice…and it is. The good news is that justice can be served. The great equalizer in this situation is the venerable debt collections agency. This tenant owed back rent, late fees, notice fees, and damages. Her total bill quickly added up to $3,300. We submitted this tenant to North American Recovery (based in Salt Lake City) to pursue her for the costs and unpaid rent. The collections agency will follow her for years, place a collections account on her credit report, and also initiate legal proceedings to get a judgement from the courts. We were able to use her deposit, though obviously inadequate, to help start to pay for the expenses.

While we may or may not actually see the funds come back to us, justice will be served. Future landlords will see the collections account on future credit reports. If the account goes unpaid, future landlords will have advance warning of the dangers of renting to this tenant. They can then take the necessary precautions if they choose to rent to her. In most cases, this means a deposit equal to two months rent. The long term consequence is that the quality and quantity of rental properties open to this particular tenant are significantly reduced. The tenant’s standard of living will suffer until the debt that is owed is fully repaid.

For these reasons, I am a strong advocate for reporting delinquent and errant tenants to collections agencies. The marketplace needs to know the true risks associated with leasing to damage-prone or deadbeat tenants. The more information that landlords can provide the credit bureaus, the better prepared the marketplace is to compensate for the risks involved.