LANDLORD CHALLENGE: Screening for Trouble

Published On: November 13, 2015 Posted by: Jeremy Peterson

Property Management is something of a renaissance profession. It requires a knack for accounting, people skills, and a healthy ability to accurately predict risk. I find the work intellectually fascinating as it merges sociology and economics into a real world experience. If you ever want to know what is really going on in the world, become a property manager.

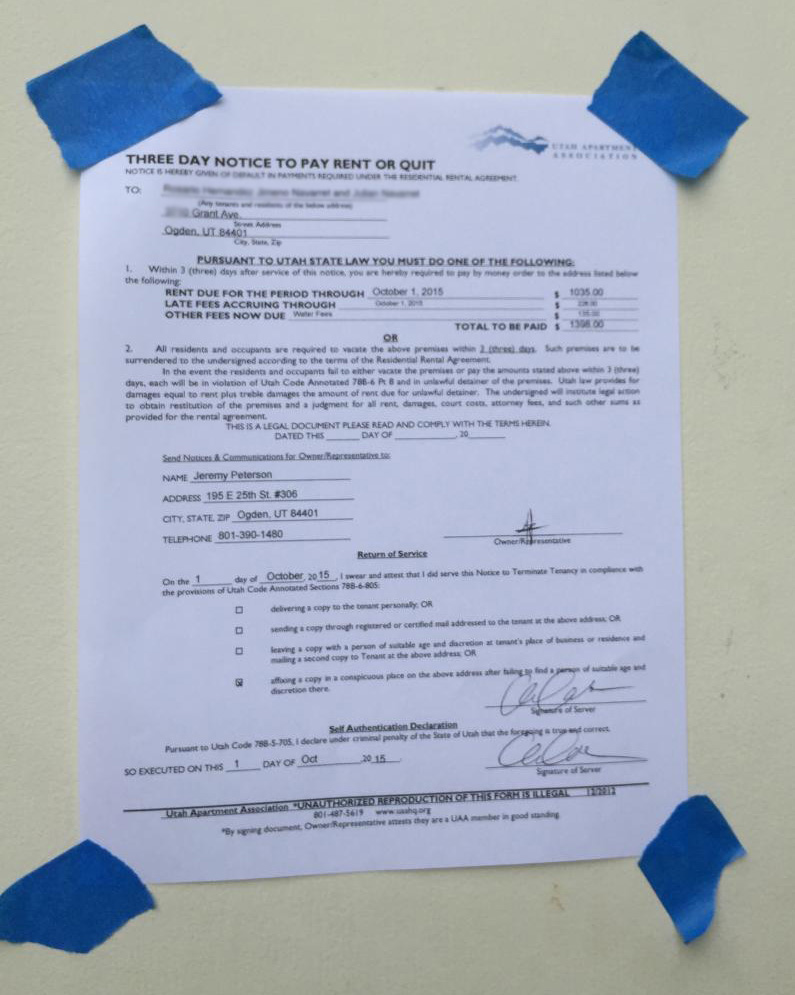

One of the great challenges that landlords face is dealing with trouble tenants. In our 11 year history of managing property, we have only had to formally evict one of our tenants. However, we have had to evict several tenants that we inherited when owners asked us to take the reigns of managing their property. A lot of this success has to do with the upfront work that we do to make sure we have quality tenants.

Here are a few of the secrets to our success:

“WILL YOU WORK WITH ME”

A security deposit is a landord’s insurance policy against unpaid rents and property damage. The security deposit is also a barrier to entry for tenants wanting to rent a place. Striking the right balance between having adequate insurance but reducing barriers is part of a landlord’s job. A security deposit equal to one month’s rent should be affordable to most tenants. Yet, once our deposit is set, we adhere to our policy. So, when we get a call from someone that says “Hey, will you work with me on the deposit?” The answer is always NO. A deposit is a tenant’s bet on themselves that they will perform to the terms of the lease. If they can’t place that bet, then they aren’t worth you betting on either. Typically this in an indicator that a tenant is not a good planner and/or saver. You are asking for drama as a landlord if you agree to “work with them”.

“MY FINANCIAL PLANNER SAYS I CAN AFFORD IT”

There are natural laws of economics at work in the housing industry. Everyone has to provide for food, clothing, and shelter for themselves. It is unreasonable to assume that someone would spend 100% of their money on rent and go hungry and naked. That nude and famished tenant would probably spook the other tenants in the apartment building anyway. So, if asking someone to pay all of their money in rent is unreasonable, what is reasonable? We follow a “three times” rule in our business. If our rents are $600/mo., our tenants must earn at least $1,800/mo. to qualify. So, 33.3% of a tenants income is a healthy level. If a tenant is spending more than this percentage on rent, your chances of being unpaid increase significantly. I had a prospective tenant once call me a on $525/mo. unit. When they told me they earned $800/mo. I told them they didn’t qualify. They were angry and indignantly responded “Huh! Well, my financial planner says I can afford it!” I hope they didn’t pay their financial planner much for that advise. So, the moral of the story is if you as a landlord violate the “three times” rule, you do so at your own risk.

“MY CREDIT AIN’T SO GOOD”

Credit makes a difference. Doing credit checks is an excellent way to determine someone’s ability to keep their obligations. However, it requires some finesse to understand the story that a credit report is trying to tell. The credit score itself is a good measuring tool but shouldn’t be the only number relied upon. For instance, I have seen applicants come in with terrible credit with scores in the low 500’s. One tenant had a laundry list of recently unpaid medical bills after experience a personal health issue. The other tenant had a similar score but didn’t pay their utility bills, walked away from a credit card, and stiffed their cell phone carrier. Which of these tenants is higher risk? While we do have some hard and fast rules on credit (we won’t rent to anyone in the 400’s), we have often been able to give tenants with credit issues a conditional approval by compensating with a higher security deposit. However, this is a subjective solution based on the specific details of the credit report. You may want to consider this approach if your property is attracting tenants with poorer credit.

These are just a few things to consider as you screen your tenants. A lot of work up front saves a lot of lost rents and headache later down the road. Hopefully these tips will help in your quest to improve your bottom line and your overall management experience.

If you are thinking about hiring professional management services, you can read about our services. Then, let me know how we can best serve you.