Uncle Sam Plays Armchair Landlord

Published On: January 26, 2023 Posted by: Jeremy Peterson

Property Managers and income property owners were given a shock this week as news from the White House indicates a major push by the Federal Government to intervene in the rental housing market. Recent announcements suggest that the balance of power in the rental housing market will be tilted more in favor of tenants under the new initiative. While the stated intentions seem noble (we haven’t seen a government proposal that isn’t wrapped in noble intentions), there is the lurking trouble of details and unintended consequences. The initiative calls itself a Renters Bill of Rights.

While it stands to reason that government should endorse best practices and provide for an even playing field between market participants, the details provided so far appear to reach beyond that scope. Here are some of the provisions discussed so far in the announcement:

SECTION 8 EXPANSION

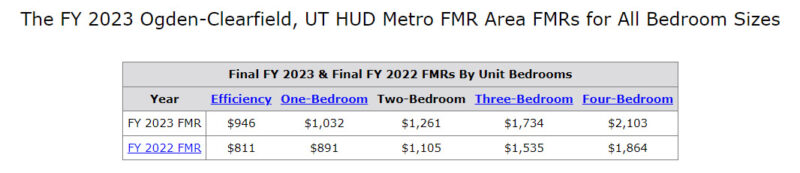

The Federal Government is boosting funding for Housing Choice Vouchers (i.e. Section 8 subsidized housing) to increase the number of qualified individuals. Locally, Ogden Housing Authority and Weber Housing Authority have had a three year waiting list for individuals wanting to apply for a voucher. These vouchers act as taxpayer subsidized rent assistance with the tenant paying a prorated amount based on means testing. Recently, the maximum caps for vouchers were raised to above market rates in order to entice landlords into accepting these tenants into their buildings. Here are the rates:

LOANS WITH STRINGS ATTACHED

The Federal Government has a litany of bureaucratic buttons to push and knobs to turn in the effort to provide additional housing for the disadvantaged. For instance, this month the FHFA has directed Freddie Mac and Fannie Mae to make 50% of their new multi-unit loan purchases “mission-directed”. This means that certain loans for financing apartment buildings won’t be made in the marketplace unless conditions set by the government are met in advance. Such conditions include guaranteeing housing for low-income tenants, rent price restrictions, and limiting rent increases caps to no more than 5% per year (regardless of inflation).

ENFORCING PROPERTY CONDITION

The Federal Government is beefing up its inspections standards and is training participating agencies in where to look for deficiencies in property that is currently housing Voucher tenants. We definitely agree that slum housing should not be part of the housing mix regardless of economic circumstances. However, landlords should be given the opportunity to protect their investment from abuse by tenants lacking proper incentives care for the property. The new inspection standards will also enhance radon testing and mitigation enforcement.

TENANT RIGHTS

The proposed program seeks to increase education about tenant rights and what responsibilities landlords have to their tenants. It proposes new legislation to make source of income a protected class under the Fair Housing Act. This is not an issue in Utah which made source of income a protected class many years ago. Efforts will also include providing lease escape provisions for victims of domestic violence, abuse, sexual assault, stalking, etc. Utah is presently proposing legislation to provide lease break provisions for victims of domestic violence. The initiative would also require landlords to explain to applicants why they were disapproved. These proposals seem reasonable and rational and are already being practiced by many market participants already.

EVICTION MANDATES AND GRACE PERIODS

Proposals on the table include taxpayers paying for defense council for tenants in eviction and requiring 30 days notice before an eviction action can be taken. Currently in Utah, if a landlord has grounds to evict a tenant, he places a notice on their door with the tenant having three business days to cure the problem. If the problem is not cured, he files a complaint with the courts and a hearing is typically scheduled about three weeks from that time. Details on the new policy are scarce. If the policy is to wait 30 days before filing a complaint with the courts, this is a very bad policy. It would mean that landlords would have to increase security deposits substantially to offset the risk of non-payment from a tenant for 30 days before filing a complaint. This policy would increase the costs for tenants and decrease access to housing which is exactly opposite of the program’s intentions.

It is also proposed that grace periods would be mandated in lease agreements. Because the accounting rhythm of property managers follows a predictable calendar cycle, a grace period adds additional uncertainty to the date in which rents might be received to be processed and redistributed to owners. Thus, it might not be unusual to see rent due dates moved to the last week of the month to make the end of grace periods be the first of the month.

There is plenty more to read in the policy blueprint:

The real policy details and implications will be forthcoming. But the warning shot has been sounded. Landlords can expect more government involvement (i.e. interference) in the rental market for better or for worse.