MARKET UPDATE: The Great Staring Contest

Published On: January 24, 2024 Posted by: Jeremy Peterson

After a prolonged staring contest, the real estate market is entering a new phase as interest rates have reached a recent peak and market participants acclimate to the new reality of the cost of money. The next chapter will be written in a year promising political, geo-political, and yet-to-be-known fireworks. Before we prognosticate on what the future holds, let’s take a look at where we left off.

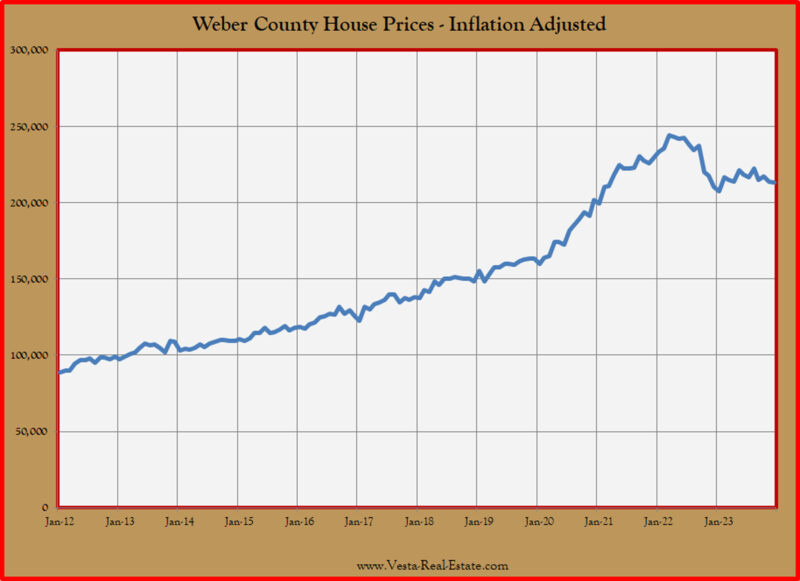

Our inflation adjusted house price chart shows that we ended 2023 just a little above where we started. A choppy mid-year bump in prices ebbed into the end of the year as interest rates spiked.

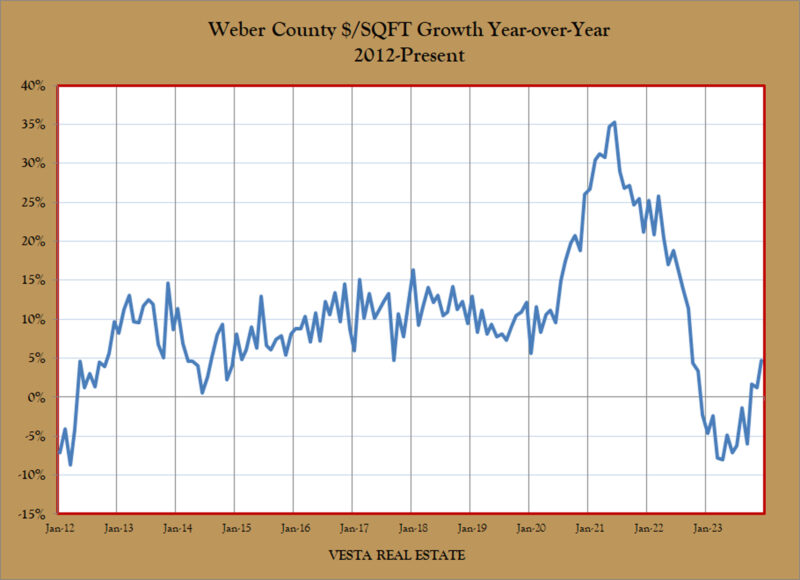

The choppy nature of house price movement is showing up in the price growth chart with YoY prices returning to positive territory once again. December prices recorded a nearly 5% bump over prices the same time last year (which were in freefall).

The sharp pointy things at the end of this chart are the pinnacles on which the market was impaled. Momentarily pricked with a rate spike above 8% in October, market participants winced. Fortunately, rates are below 7% and seem to be holding there for now.

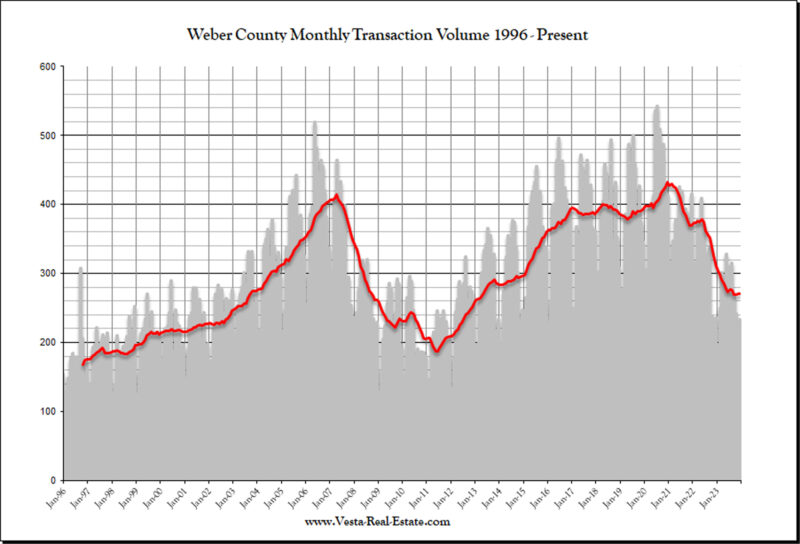

Sales volume was trying to find a bottom in 2023.

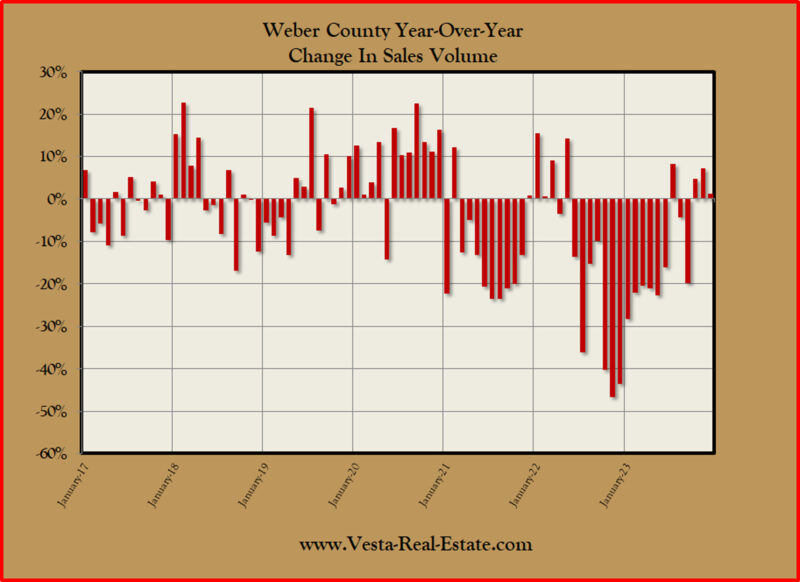

The year-over-year picture for sales volume seems to indicate that sales volume is stabilizing. The pattern however looks a bit like an echo of 2021. We shall see what plays out.

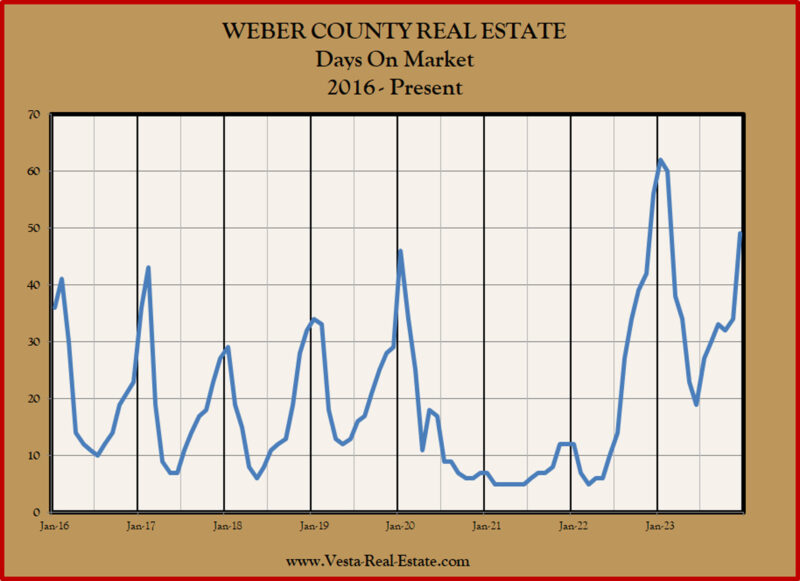

Our days-on-market cycle is returning to a more normal seasonal pattern after the COVID-era craziness. Peak sales times should be here soon before dropping into the Spring rush.

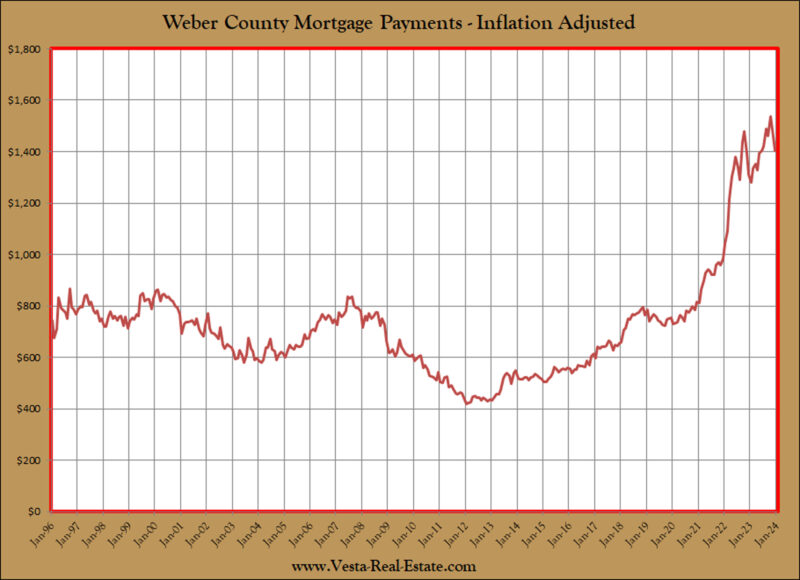

Affordability is slightly better than the worst it has ever been. At this point, we will take what we can get.

Looking forward, it is going to be an interesting year. With elections on the horizon, policymakers have strong incentives to keep financial markets on a steady course and avoid unnecessary provocations. Nevertheless, there are some major decisions that need to be made that may impact the real estate market. A lot of focus has been on the Federal Reserve and the expectation that interest rates will be reduced in coming months, perhaps as soon as March. However, rates are high as an antidote to ongoing inflation. A rate reduction may stoke more inflation, especially in housing, and make things even less affordable. There isn’t an easy answer here.

Another major policy decision will be made in March when a temporary emergency bank funding program will be either extended or ended. The program was put in place to prop up regional banks after the failure of Silicon Valley Bank in March 2023. Extending the program may have inflationary impacts. Ending it may cause some wobbly regional banks to tip over. Such an event could make loans less available while risk is reassessed.

Geo-political events around the world, especially war, could have a stifling effect on trade and make products more rare and expensive to purchase. There is already a shortage of basic home building supplies like electrical meters. These kinds of issues may make new homes more expensive and delay construction thus pushing up the price of housing.

The final wild card is national political events. In 2020, a wave of migration was unleashed as work-from-home employees sought destinations more in line with their lifestyle preferences. This national migration trend has continued with Utah being the beneficiary of large in-migration. This population increase has been a major factor in our house price melt-up before 2022. Yet, businesses are now requiring workers to return to their offices which is unwinding some of this effect. Nevertheless, many interstate movers are relocating, not for work reasons, but seeking ideological harmony. Will political events stoke another wave of migration to Utah?

Which ever way you look at it, this next year promises to be exciting. If you are in the market to buy or sell your home and need an expert to help you, give me a call at 801-390-1480.