Real Estate Sales vs. Mortgage Rates

Published On: October 18, 2023 Posted by: Jeremy Peterson

A lot of attention has been paid to mortgage interest rates over the past two years as rates have soared from a low of 2.77% in August 2021 to today’s nosebleed rates approaching 8%. Obviously, higher rates have translated into lower sales volumes. But, real estate sales aren’t just affected by the level of interest rates. They are also affected by the direction and speed which rates move regardless of level.

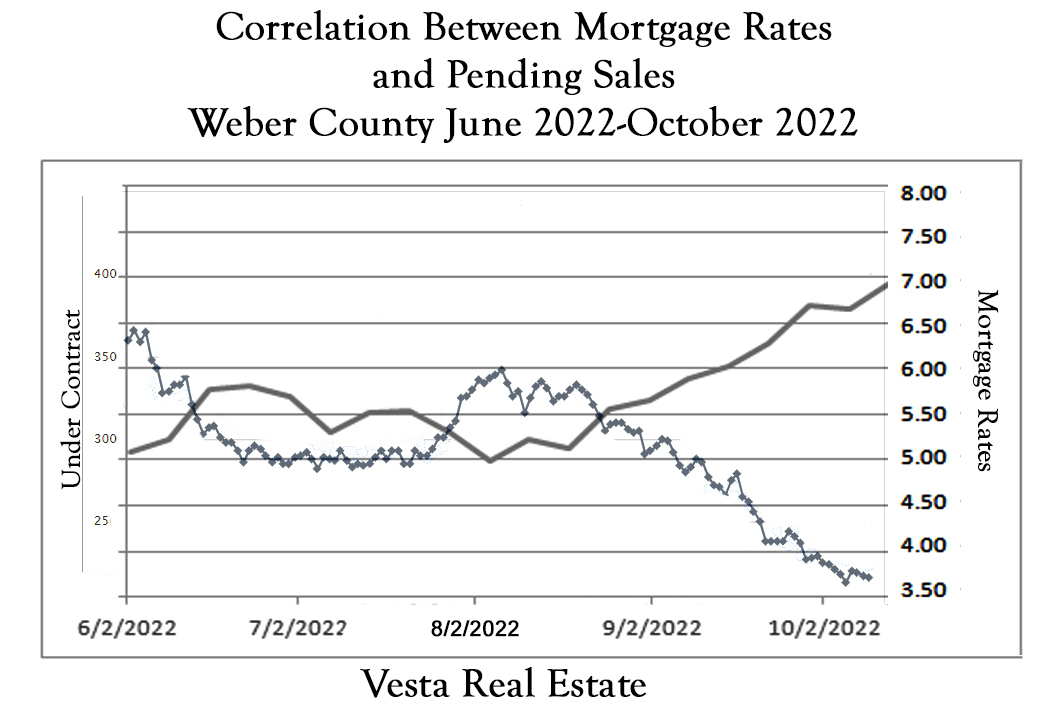

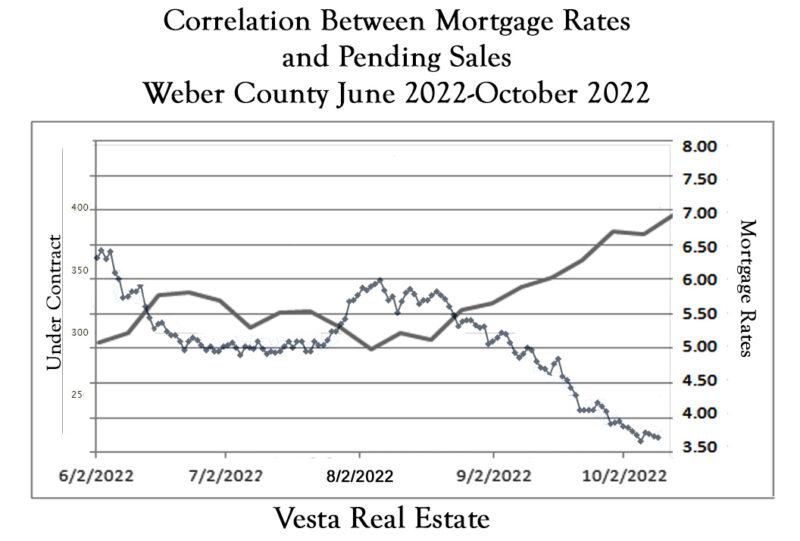

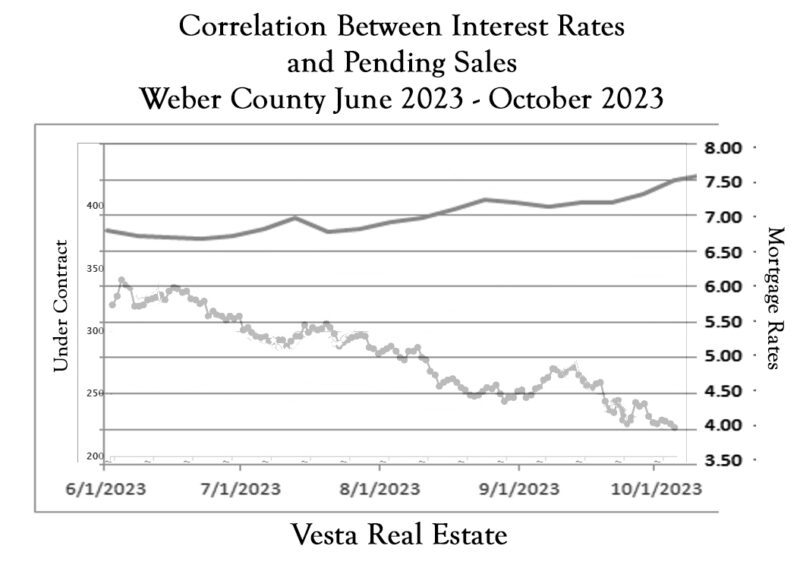

To illustrate the point, let’s take a look at the time period between June and October in both 2022 and 2023.

As you see in the chart above, sales in Weber County were depressed beginning in June as rates reached 5.75%. When rates dropped to 5% there was a dramatic increase in market activity. Then as rates began to increase again, sales declined continuously through October as rates quickly approached 7%.

In 2023 we see a different pattern as rates begin at 6.8% in June. Sales volume was slightly more depressed than the prior year at the same time. In mid July we see rates drop from 7% to 6.8% and we see a pop in sales activity at that time. That activity subsides as rates climb above 7%. Then in mid-September we see another pop in activity as rates drop from 7.2% to 7.1%. Then rates arrive at today’s historic high as sales volume continues to sag.

It is good to keep in mind that the downtrend in sales volume for this time period is normal due to the seasonal rhythm that is part of Utah’s yearly sales cycle. But, interest rates have exaggerated this effect and the short term boosts in sales activity that happen when rates change direction is an indicator of how important they are in today’s market.

Also, the decline in volume has happened while rates have been increasing. If rates plateau or increase more slowly, it is very likely that sales activity would begin to increase again over time. So far though, the rise in rates has been unrelenting.

So, if you are in the market for a home, be nimble, be quick, and when your loan officer calls to tell you that rates are dropping, be ready to take action. If you are thinking about purchasing a home and want an expert to help guide you through this dynamic marketplace, give me a call. 801-390-1480