THE TENANT DEATH SPIRAL: From Lease To Oblivion

Published On: April 6, 2016 Posted by: Jeremy Peterson

Our brokerage has an excellent track record of screening and placing well qualified tenants in the rental units we manage. Many of our clients choose us over other property management companies due to this reputation. However, when we assume management of a property with existing tenants in place, we often have to replace under-qualified tenants as they start to under-perform. We had such a situation occur this past month.

On February 1st we assumed management authority for a rental unit on Harrison Blvd. in Ogden. We quickly placed a great tenant in the vacant basement unit. Yet, our rigorous management policies quickly collided with the tenant upstairs. The tenant upstairs made several partial payments in February to pay rent. Unfortunately, each EFT payment they attempted to make bounced. After the third bounce in a week, we revoked their EFT privileges and demanded payment in cash or cashiers check. They promised February and March rent shortly after the first of the month. In good faith, we agreed to give them to the first week in March to pay in full. While I was out of the office, we received full payment and it was deposited. What I didn’t know was that she paid with a regular check. We found out about a week later after our bank returned the check to us for non-sufficient funds.

At this point, we immediately issued a 3-day notice to vacate the premises. We also contacted our attorney to begin the eviction process. The tenant responded to our complaint we filed with the courts and a hearing date was set. The tenant pleaded for an opportunity to make up for the overdue rents and fees. I reviewed her lease and her previous landlord had put a $25/PER DAY late fee clause in her paperwork. That was a usurious and onerous fee structure which ballooned her outstanding balance to an amount that was beyond payable. At that time, I adjusted her late fee to $3 per day and swapped out attorney fees for the unseemly late fees that accumulated on her account. We both felt this was equitable. She promised to pay Febrary, March, and April’s rents with all late fees due by April 2nd. Our final court hearing was scheduled for April 5th.

Well, the 2nd of April came and went without event. The morning before our court hearing the tenant wandered into my office and apologized for not taking responsibility sooner for her situation. Tragically, she had some recent deaths in her family and was not handling the situation well. It turns out that rents were not the only bills that had gone unpaid. We discussed what was going to happen at the court and I explained that she would be physically removed and locked out of her home in about a week. We both agreed that it would be best for her to vacate prior to that event. She thanked me for my time, shook my hand and walked out the door.

The courts signed the writ of restitution the next morning. I delivered the signed copy to her personally and she indicated she had found a place to stay and would call me to pick up the keys when she had moved out over the weekend.

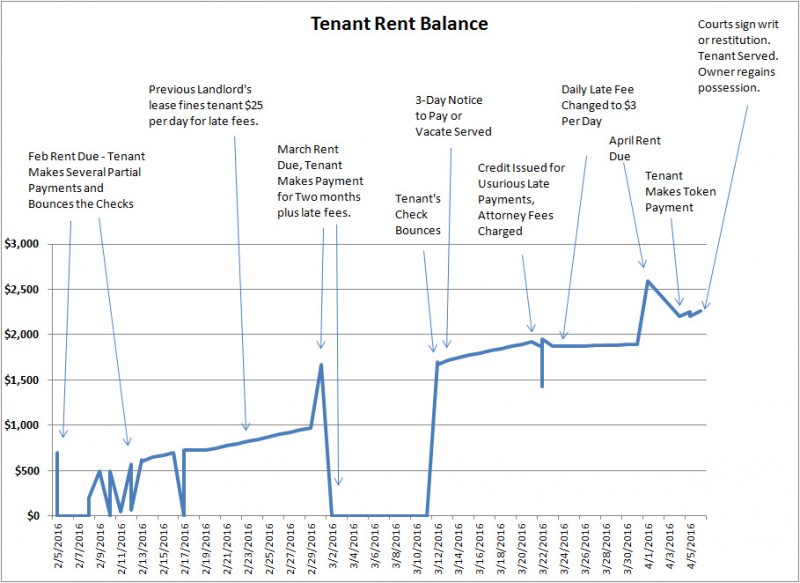

This is a sad story. Here is a chart showing the important events and accumulating balance:

The moral here is that once a tenant gets behind on rents, the likelihood that they recover and catch up is very low. It is important for landlords to recognize this as soon as possible to avoid collections and vacancy costs. It is also important to recognize that tenants often have an avoidance mentality. They often don’t take the bull by the horns to correct a problem and simply hope that it goes away on its own. This is why it is so important for property managers to make sure notices happen in an orderly and predicable way. If an eviction can be avoided, that is great. If a tenant can be educated on the financial and legal peril they face if they are evicted, the faster a resolution can be achieved.

If you are needing a sharp property manager to make sure your income property stays profitable and hassle-free, CONTACT US, and we can show you how we make owning investment property a care free experience.